Kalyan Jewellers: Expanding Horizons with Robust Growth and Global Presence

Kalyan Jewellers India Limited: Overview

Kalyan Jewellers India Ltd. designs, manufactures, and sells a diverse range of gold, studded, and other jewellery products catering to various price points. Founded by Chairman and MD T.S. Kalyanaraman, the company is one of India’s largest jewellery retailers, with approximately 6% of the organized market share. Its offerings include wedding jewellery under the Mahurat brand, aspirational handcrafted pieces under brands like Mudhra and Rang, value-oriented regional jewellery under Aishwaryam, and studded collections like Nimah and Ziah. Gold jewellery contributes 73% of its product mix, while studded jewellery accounts for 25%. By FY24, Kalyan expanded to 204 showrooms in India (up from 124 in FY22) with over 711,000 sq. ft. of retail space in India and 44,000 sq. ft. across four Middle Eastern countries. The company is transitioning to a Franchisee Owned Company Operated (FOCO) model in regions like South India and the Middle East to optimize capital investment and boost operational margins.

Latast Stock News (9 Jan 2025)

Kalyan Jewellers India Ltd reported a consolidated revenue growth of approximately 39% for Q3 2025 compared to previous year quarter. The jeweller has launched 24 Kalyan showrooms in India during recent quarter. The Middle East recorded 22% growth and contributes 11% to the revenue of Kalyan Jewellers Ltd. The company has also launched its first showroom operated by company itself in USA. Company is planning to launch 30 Kalyan and 15 Candere showrooms during current quarter.

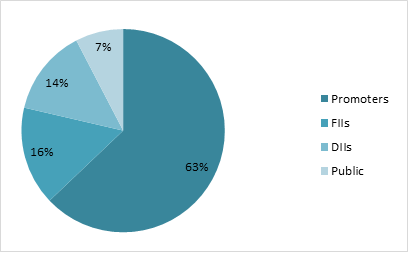

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹72867 Crore |

| Revenue | ₹21385 Crore |

| Profit | ₹626 Crore |

| ROCE | 14.04% |

| P/E | 117 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Kalyan Jewellers | 72876 | 21358 | 626 | 14.04% | 1.58 | 51.7 | 1.04 | 117 |

| Titan Company | 309384 | 54458 | 3243 | 22.7% | 1.74 | 57 | 2.22 | 95 |

| Senco Gold | 9202 | 5654 | 218 | 13.8% | 1.58 | 21.6 | 1.3 | 42.1 |

| PC Jewellers | 8144 | 995 | 15.4 | -1.74% | 0.08 | 76 | 1.17 | 532 |

| P N Gadgil Jewel. | 9125 | 6032 | 155 | 30.8% | 4.8 | 32.9 | 0.16 | 59.1 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 10101 | 8573 | 10818 | 14071 | 18548 |

| Expenses | 9302 | 7949 | 9965 | 12906 | 17180 |

| EBITDA | 799 | 624 | 853 | 1165 | 1368 |

| OPM | 8% | 7% | 8% | 8% | 7% |

| Other Income | 80 | 45 | 38 | 5 | 74 |

| Net Profit | 142 | -6 | 224 | 432 | 596 |

| NPM | 1.4% | -0.1% | 2.1% | 3.1% | 3.2% |

| EPS | 1.7 | -0.06 | 2.18 | 4.2 | 5.8 |

Stock Price Analysis

In terms of performance, Kalyan Jewellers India has shown a return of -2.21% in one day, -8.86% over the past month, and -0.55% in the last three months. The stock has experienced fluctuations today, with a low of ₹663.6 and a high of ₹725.4, over the past 52 weeks; the shares have seen a low of ₹322.05 and a high of ₹794.6. The stock has given great returns since its listing and the trading volumes are also high showing high interest from investors.